Easy, Credit Card Processing for Entrepreneurs

PaidUP Payments is a comprehensive Merchant Processing Company that offers a wide range of solutions, more specifically, credit card processing for small businesses.Whether you're a solopreneur or a large enterprise with 10,000 employees, we have the perfect solution for your payment processing needs. What's more, all our solutions are backed by the PaidUP Promise! With PaidUP Payments, you can trust that your payment processing requirements are in capable hands.

Streamlined Payments Solutions For Small Businesses!

The PaidUP Credit Card Processing for Small Business Promises

Month-to-Month Contracts

We will never lock you into a long term contract. We believe we should earn you business each and every month.

24/7 U.S. Based Support

We offer 24/7, US based support. You will never be shut down due to inability to accept payments.

Compliance Assistance

We are available to you to ensure you understand what it means to be compliant, and will assist you in any way necessary to ensure you are protected.

Equipment For Your Needs

We will work with you to find the best solution for you business. We will never prioritize money over your satisfaction. We will find the right equipment for your operation and ensure a fair price or free placement.

Transparent Pricing

We will ensure you understand ALL costs associated with your processing. We even offer plans with NO FEES!

Our Trusted Partners

Optimized Solutions for Your Business

FREE PLAN AVAILABLE

FULL DATA COMPLIANCE

100% TRANSPARENT COSTS

COMMITMENT FREE

MOBILE PAYMENT APP

RECURRING INVOICES & DRAFTS

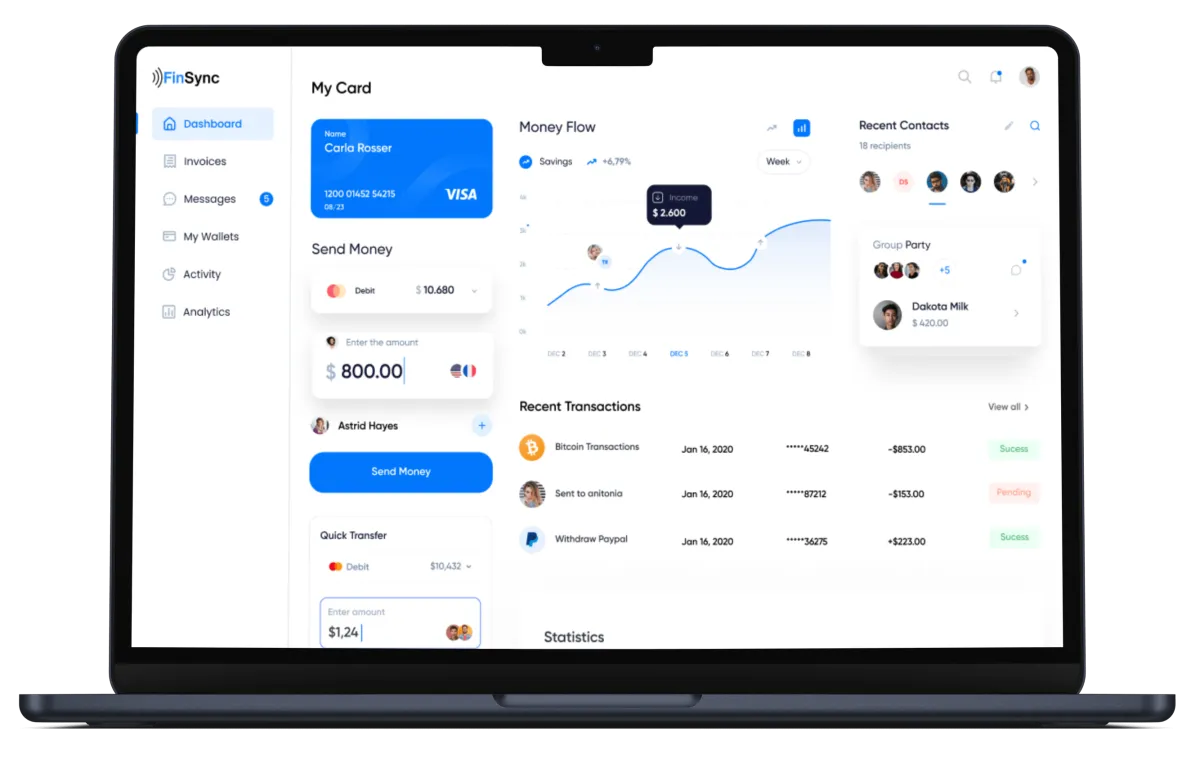

Your All-In-One Payment Solution for Seamless Transactions

We partner with you to understand your business needs and tailor payment solutions that fit your goals. By staying on top of industry trends, we leverage innovative technologies to streamline payments and boost your business efficiency.

Focus on Business Growth

Accept Major Credit Card Payments and Enjoy Instant Fund Transfers with Our Secure Platform.

Simple Payment Process

Complete payments in just three clicks with an intuitive interface.

Comprehensive Reports

Access powerful reports that drive smarter decisions.

Rapid Fund Transfers

Enjoy fast payouts with instant fund disbursement.

Uninterrupted Access to Your Funds, Guaranteed

Entrepreneurs, freelancers, and service providers that use DigiPay always enjoy peace of mind with the fastest payout in the industry.

Instant Payouts

Authority stats and other lorem ipsum

Results and experience lorem ipsum

Enhance Your Payment Solutions Now

Maximize Your Transactions with PaidUP Payment’s Innovative Solutions, Featuring Instant Fund Access, Payment Acceptance in 164+ Currencies, and More.

Set Up Your Profile

Quickly set up your account in just a few simple steps.

Verify Your Information

Confirm your account with an easy email verification process.

Start Accepting Cards

Enjoy instant payouts and seamless credit card processing.

See What Our Customers Have to Say

“PaidUP Payment’s service has been a game-changer for our business and growth.”

They exceeded all my expectations. From the beginning, their professionalism, expertise, and commitment to delivering exceptional results stood out. PaidUP Payment’s in-depth market research provided valuable insights, shaping our strategy effectively.

John Matthews

Finance Manager at ????

Discover Our Competitive Pricing Options

Experience complete price transparency, so you’re always aware of your costs.

Basic PLAN

$47/m

Robust security with top-tier encryption.

Accept payments in 150+ currencies.

24/7 customer support via phone, chat, or email.

Instant payouts for fast access to funds.

No contracts - cancel anytime

PRO PLAN

$97/m

All features from Basic Plan included.

Advanced security with extra protection.

Global payment acceptance in 164+ currencies.

Priority support for quicker assistance.

No contracts - cancel anytime

AGENCY PLAN

$147/m

"All features from Pro Plan included.

Premium security with enhanced compliance.

Custom payment solutions for your business.

Dedicated account manager for personalized support.

No contracts - cancel anytime

Frequently Asked Questions

Explore Our Common Queries and Solutions

How do I pass the fees?

The trend of passing fees onto customers is gaining momentum. However, it is important to note that this practice is illegal in certain states and goes against the processing agreement set by major credit card companies. To address this challenge without incurring costs for your business, a dual pricing model can be implemented.

What is dual pricing?

In a dual pricing model, businesses set two different prices for their offerings: a retail price and a cash price. The retail price includes the cost of processing fees associated with credit card transactions, while the cash price reflects a discounted amount for customers who pay with cash or other non-card payment methods. This approach allows businesses to recover the processing fees without directly passing them onto customers and potentially violating legal or contractual obligations.

What are interchange fees?

Interchange fees, also known as interchange rates or swipe fees, are transaction fees charged by credit card networks (such as Visa, Mastercard, or American Express) to the merchant’s bank (acquirer) for processing credit or debit card transactions. These fees are a fundamental component of the payment ecosystem and help cover the costs associated with facilitating electronic payment transactions.

How does pricing work?

Flat Rate Pricing: This model offers simplicity and predictability by charging a fixed percentage or flat fee for each transaction, regardless of the card type or transaction value. It is often preferred by small businesses or those with low transaction volumes.

Interchange-Plus Pricing: In this model, the merchant pays the actual interchange fee set by the card networks, along with an additional fixed markup or percentage fee charged by the payment processor. It provides transparency as the interchange fees are passed through directly, but it can be more complex to understand and analyze.

Tiered Pricing: With tiered pricing, transactions are categorized into different tiers or pricing levels based on factors such as card type (e.g., debit, credit), transaction method (e.g., swiped, keyed), and risk level. Each tier has its own predetermined rate. While it offers simplicity, it may lack transparency, as the specific rates for each tier may not be clearly disclosed.

Which pricing model works best for my business?

The choice of a pricing model for merchant services depends on various factors, and each model comes with its own set of advantages and disadvantages. Our team is here to assist you in making an informed decision. We can assess your latest statements and provide you with a comprehensive analysis of how each pricing model would impact your bottom line. Feel free to reach out to us, and we’ll guide you through the process.

© 2026. PaidUP Payments. All rights reserved.

Privacy Policy

Terms of Use